In the intricate landscape of forex trading, where each candlestick communicates a unique aspect of market dynamics, the Marubozu pattern stands out as a powerful indicator of strong market sentiment. Traders often turn to this distinctive candlestick formation to gain insights into potential trend continuations or reversals. This article aims to provide a comprehensive understanding of the Marubozu candlestick pattern and its significance in the realm of forex analysis.

Definition of Marubozu:

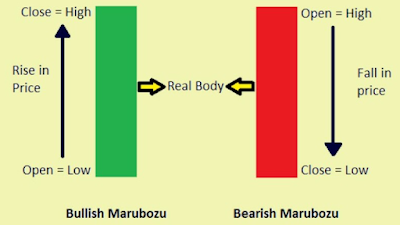

A Marubozu is a Japanese candlestick pattern characterized by a candle with little to no shadows (upper or lower) and a significant real body. The absence of shadows indicates that the opening price is equal to the low (for a bullish Marubozu) or the closing price is equal to the high (for a bearish Marubozu). This results in a candlestick with a long, solid body, signifying strong and decisive market action.

Key Characteristics of Marubozu:

1. **Long Solid Body:**

- The candlestick has a long and solid body, indicating that the opening price (for a bullish Marubozu) or the closing price (for a bearish Marubozu) is significantly different from the low or high, respectively.

2. **No or Very Small Shadows:**

- Marubozu candles have little to no shadows, underlining the dominance of either buyers or sellers throughout the trading session.

3. **Strong Market Sentiment:**

- The absence of shadows suggests that the market sentiment is powerful and one-sided, with either bulls or bears in control.

Interpreting the Marubozu Pattern:

1. **Bullish Marubozu:**

- A bullish Marubozu indicates strong buying pressure. It suggests that buyers dominated the entire trading session, leading to a significant price increase.

2. **Bearish Marubozu:**

- Conversely, a bearish Marubozu signals strong selling pressure. Sellers controlled the market throughout the session, resulting in a substantial price decline.

3. **Trend Continuation or Reversal:**

- Depending on the context, Marubozu candles can suggest either a continuation of the existing trend or a potential reversal. Traders often look for confirmation from other technical indicators or patterns.

Trading Strategies with Marubozu:

1. **Confirmation with Volume:**

- Confirm the validity of a Marubozu signal by analyzing trading volume. Higher volume during the formation of a Marubozu can enhance the reliability of the pattern.

2. **Combine with Support/Resistance:**

- Identify key support or resistance levels. A Marubozu near these levels may suggest a potential reversal or continuation.

3. **Multiple Marubozu Patterns:**

- Look for clusters of Marubozu candles for stronger signals. Multiple consecutive Marubozu candles in the same direction can reinforce the prevailing trend.